| Combined Tax Rate |

| City of Georgetown $0.374000 |

| Williamson County $0.3381160 |

| Georgetown ISD $1.2316000 |

Property Tax Per Capita

| Revenues – Property Tax |

2019 |

2020 |

2021 |

2022 |

2023 |

| Total Property Tax |

30,561,661 |

33,808,580 |

36,886,143 |

40,220,000 |

48,630,000 |

| Population |

62,500 |

72,589 |

79,604 |

81,942 |

83,529 |

| Per Capita Revenue |

489 |

466 |

463 |

491 |

582 |

Property Tax Budgeted Revenue

| Fiscal Year |

2021 |

2022 |

2023 |

| Maintenance and Operation Revenue |

15,976,505 |

17,100,000 |

18,700,000 |

| Debt Service Revenue |

18,750,000 |

23,120,000 |

29,930,000 |

Assessed Value

| Assessed Value |

Amount |

| FY2019 |

7,830,350,417 |

| FY2020 |

8,691,478,656 |

| FY2021 |

9,174,336,112 |

| FY2022 |

10,992,195,164 |

| FY2023 |

15,076,413,021 |

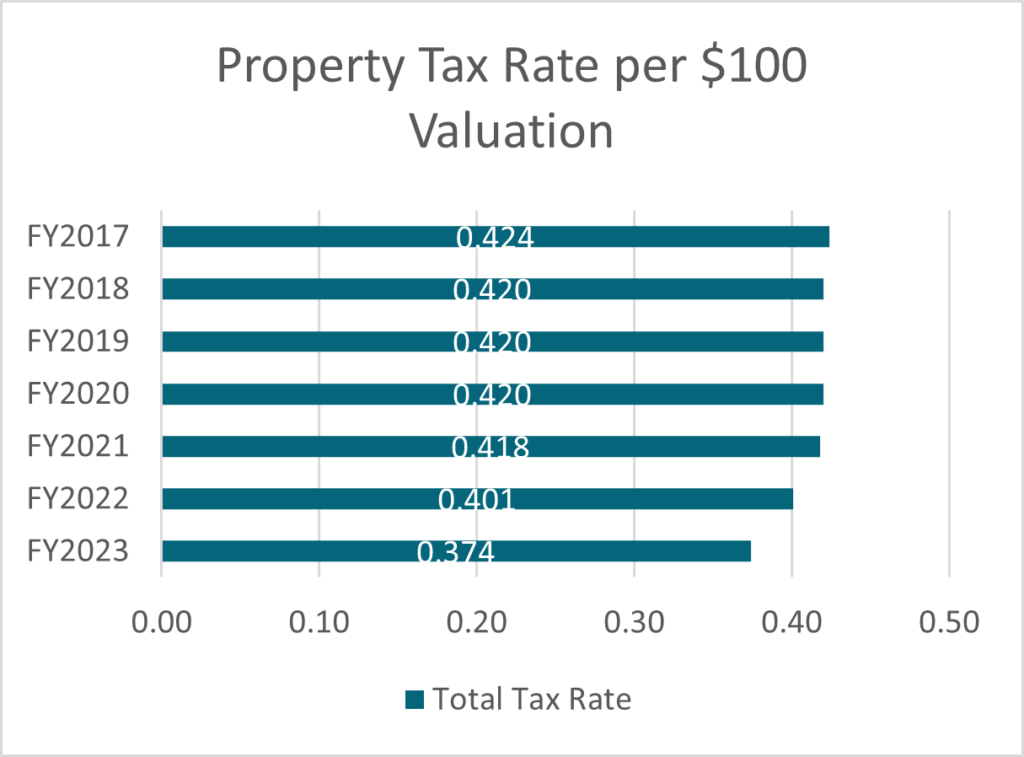

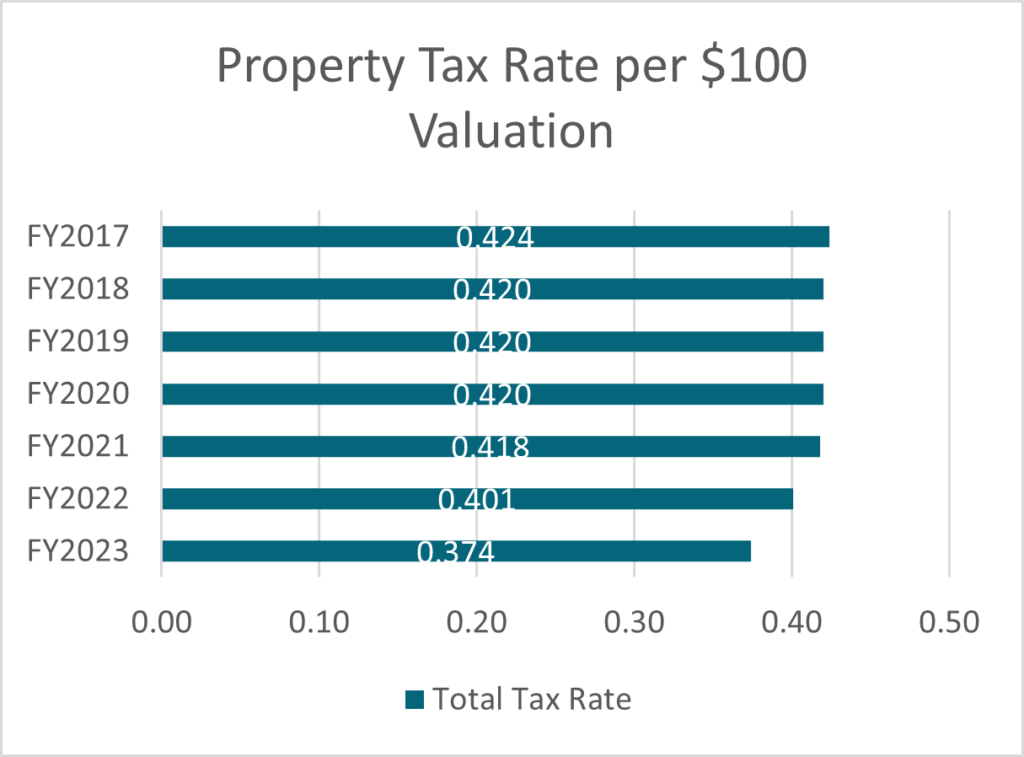

Components of Tax Rate

| Fiscal Year |

Operations & Maintenance |

Debt Service |

| FY2019 |

0.19955 |

0.22045 |

| FY2020 |

0.19547 |

0.22453 |

| FY2021 |

0.19318 |

0.22481 |

| FY2022 |

0.161319 |

0.239681 |

| FY2023 |

0.132190 |

0.241810 |

Truth in Taxation

| Truth in Taxation |

Amount |

| No New Revenue Rate |

0.320961 |

| Voter Approval Rate |

0.374762 |

| Adopted Rate |

0.374 |

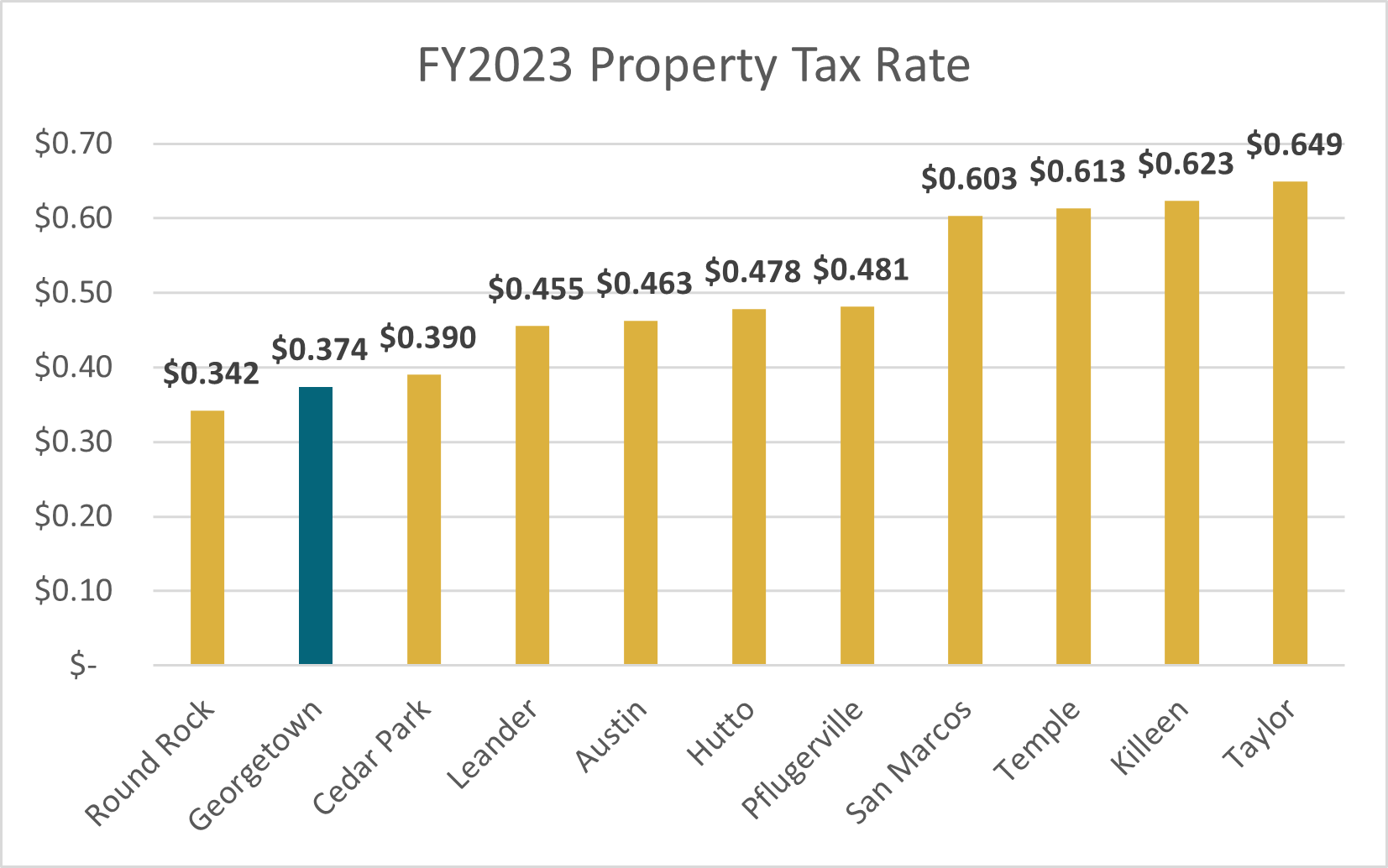

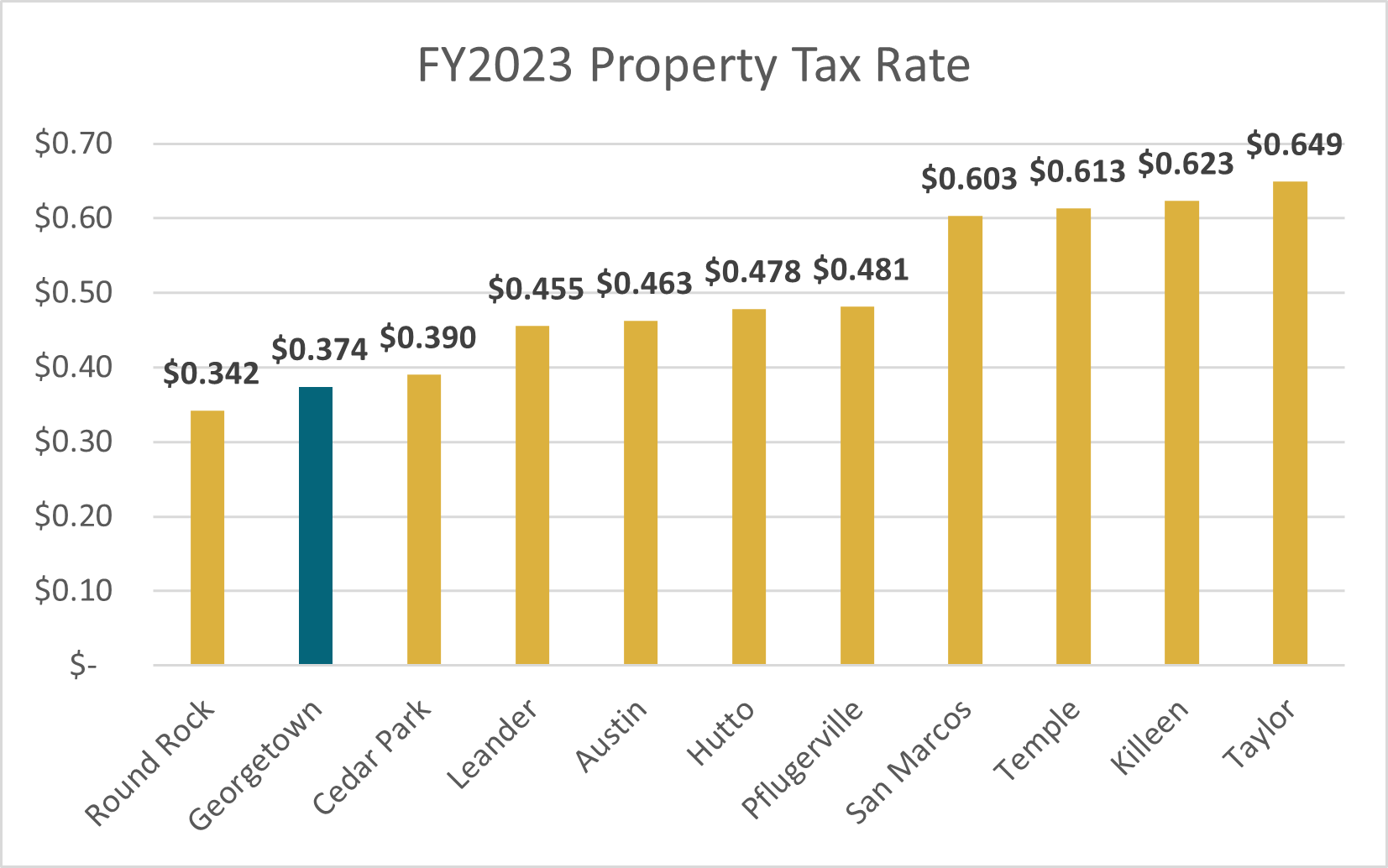

The adopted rate is 37.4 cents per $100 valuation, and represents one of the lowest rate in the greater Austin MSA with a population over 20,000. The no new revenue tax rate is the rate the City would need to charge in order to produce the same amount of property tax revenues as last year while using the new valuations of the current year. Typically, property values appreciate from year to year. In most years, the increased value of a property means a lower tax rate could produce the same amount of revenue. For example, a home valued at $100,000 with a tax rate of 37.4 cents would produce $374 in property tax revenue. If in the following year, the home is now valued at $105,000, the effective rate would be 35.6 cents to produce the same $374 worth of revenue. The no new revenue rate enables the public to evaluate the relationship between taxes for the prior year and for the current year. The voter approval rate is the maximum tax rate the City can set before the taxpayers can petition for an election to reduce the tax rate. After adjustments for debt calculations, the voter approval rate is equal to the effective rate times 3.5%, or in this example 37.4762 cents for FY2023.