Debt Transparency

The Finance Department is committed to providing sound financial leadership with a collaborative and innovative approach.

Transparency is a key component to our financial leadership and it provides our citizens with information and promotes accountability.

The City’s current outstanding debt is comprised of general obligation (GO) bonds, certificates of obligation (CO) debt, and utility revenue bonds.

General Obligation Bonds: are debt instruments issued by State and local governments as a source of funds for the acquisition and construction of major capital equipment, infrastructure, and facilities. They are backed by the full faith and credit of the issuer, including the power to tax its citizens. GO bonds must be approved by the voters and the City is required to compute at the time other taxes are levied, the rate of tax required to provide a fund to pay interest and principal at maturity.

The City’s General Obligation bonds are rated AAA by Standard & Poor’s.

Certificates of Obligations: are generally short-term in nature. They are backed by taxes, fee revenues, or a combination of the two and do not require a vote by the citizens.

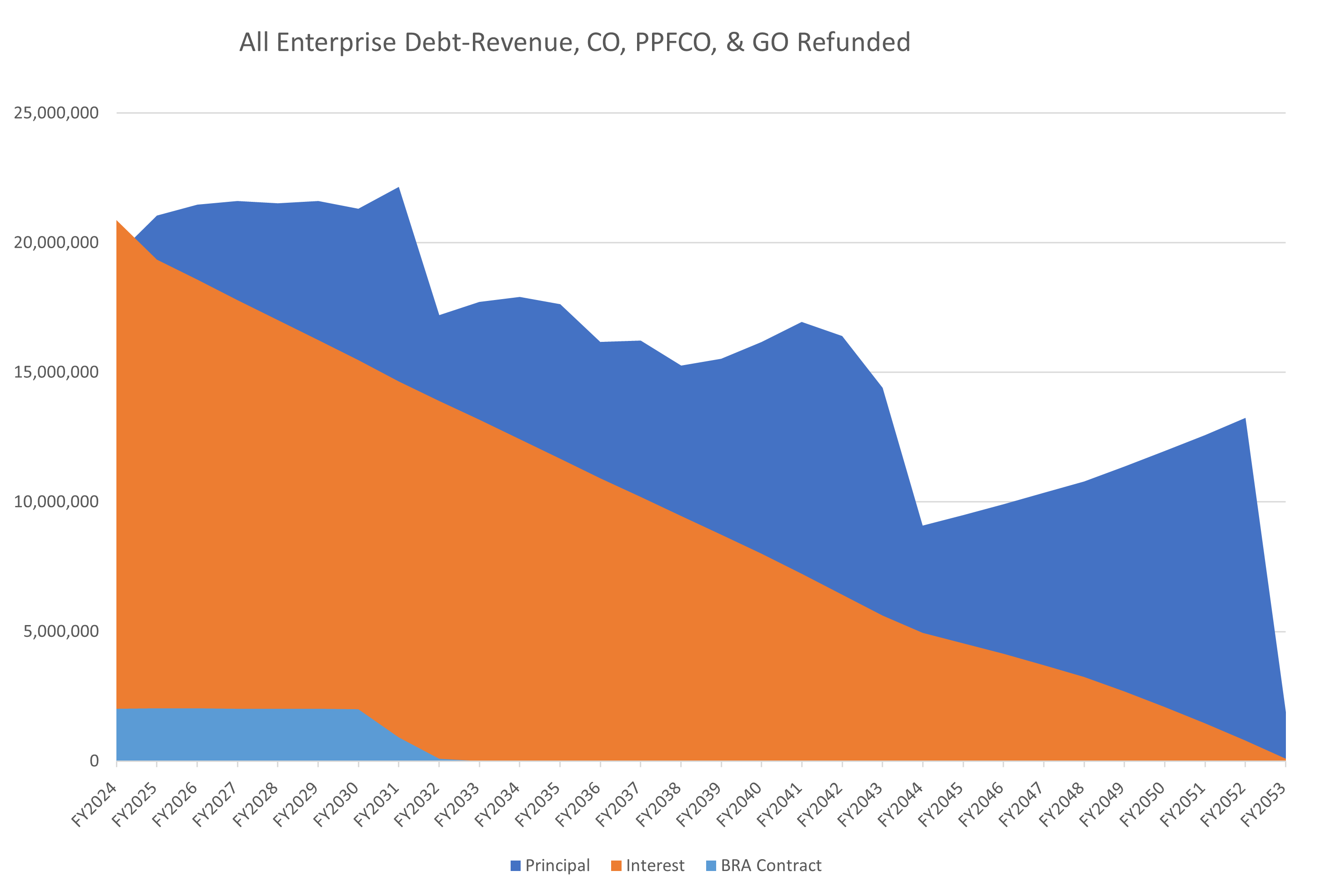

Utility Revenue Bonds: are issued to fund capital projects for the electric, water, sewer and drainage systems and related facilities. They are repaid with utility revenues.

The City’s utility revenue bonds are rated A+ by Standard & Poor’s. The City’s Utility Revenue Bonds are rated AA- by Fitch

Sales Tax Revenue bonds: have been issued to fund transportation improvements. The bonds are to be repaid from revenues of the Georgetown Transportation and Enhancement Corporation (GTEC).

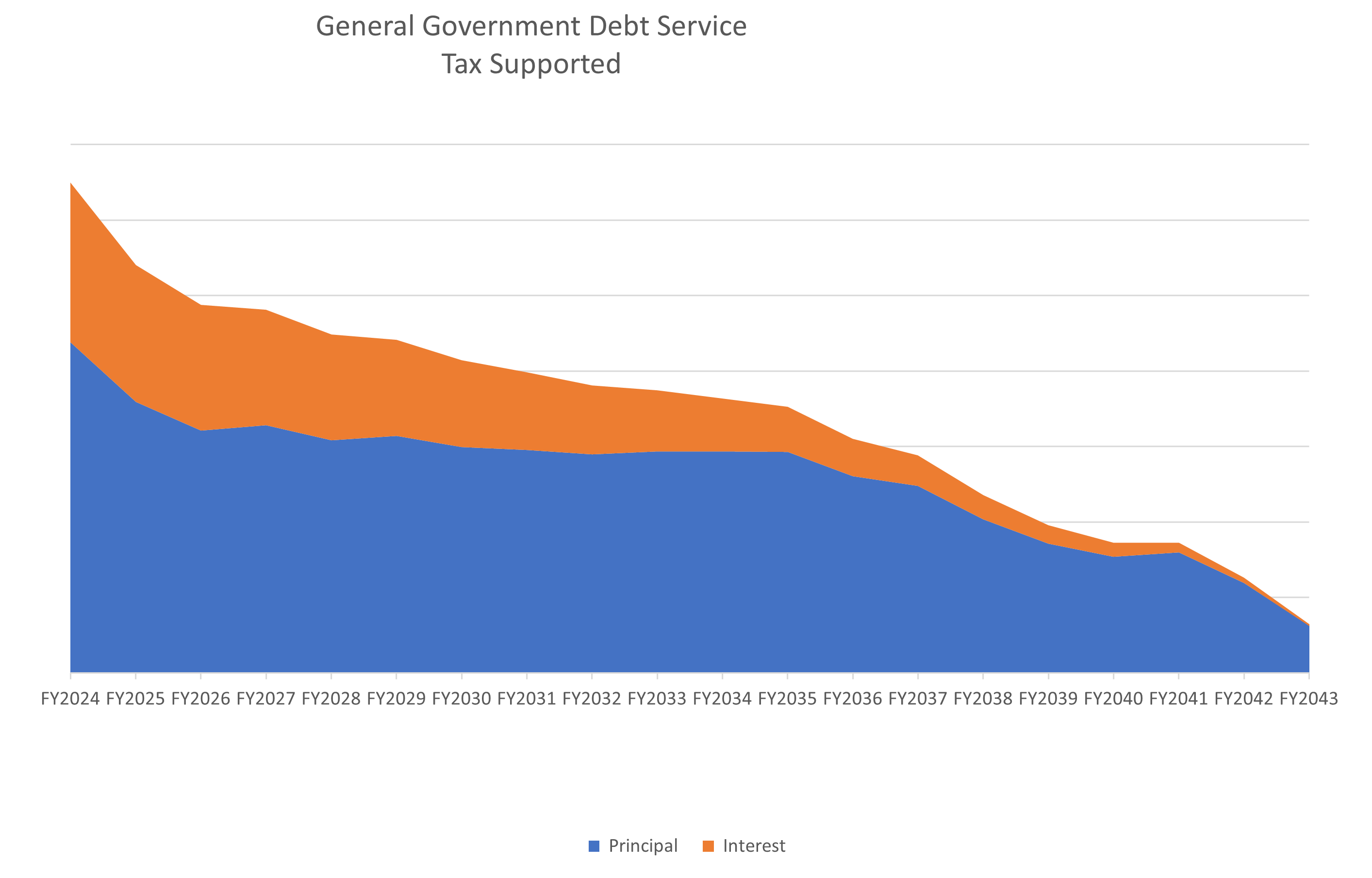

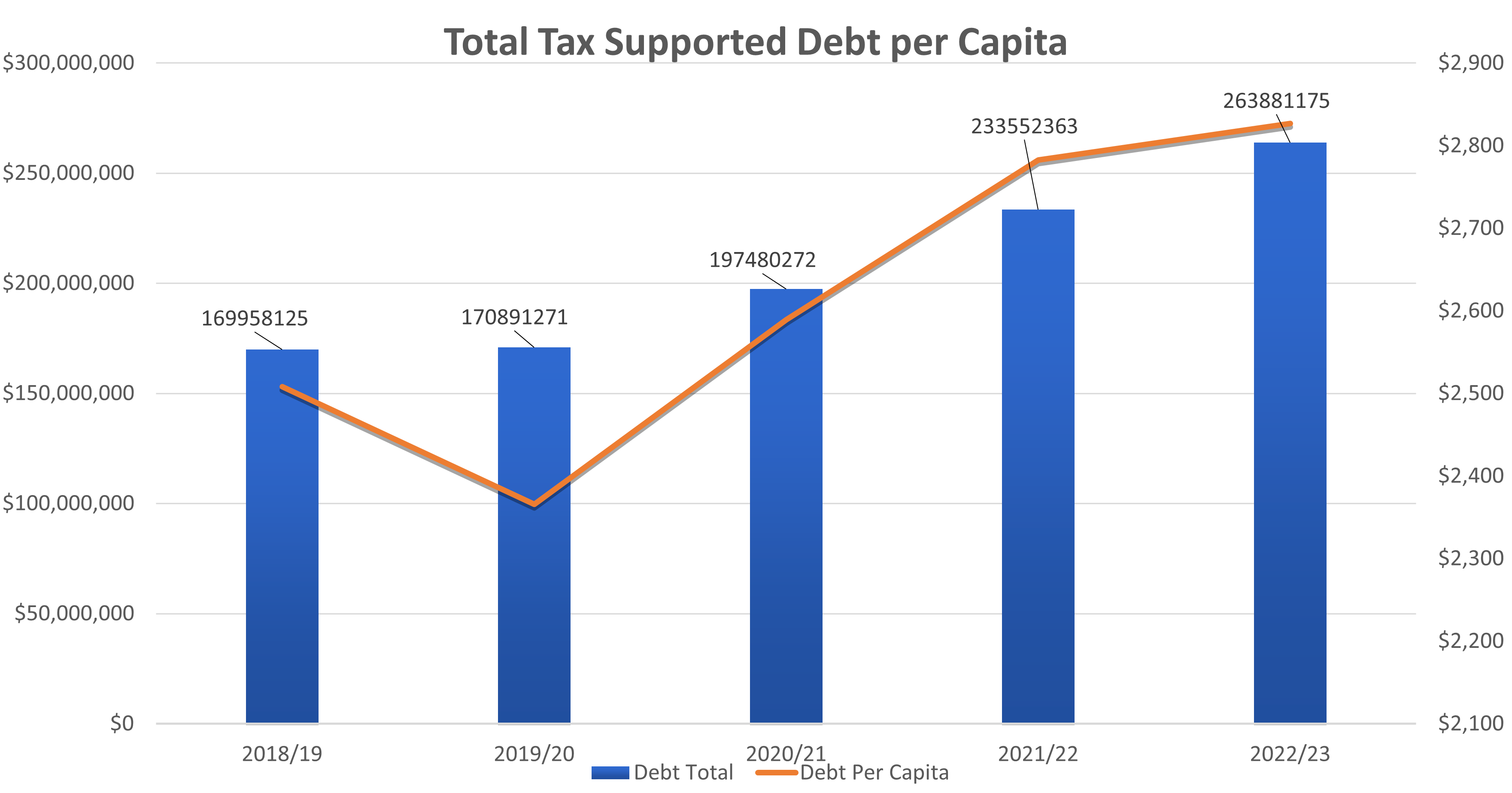

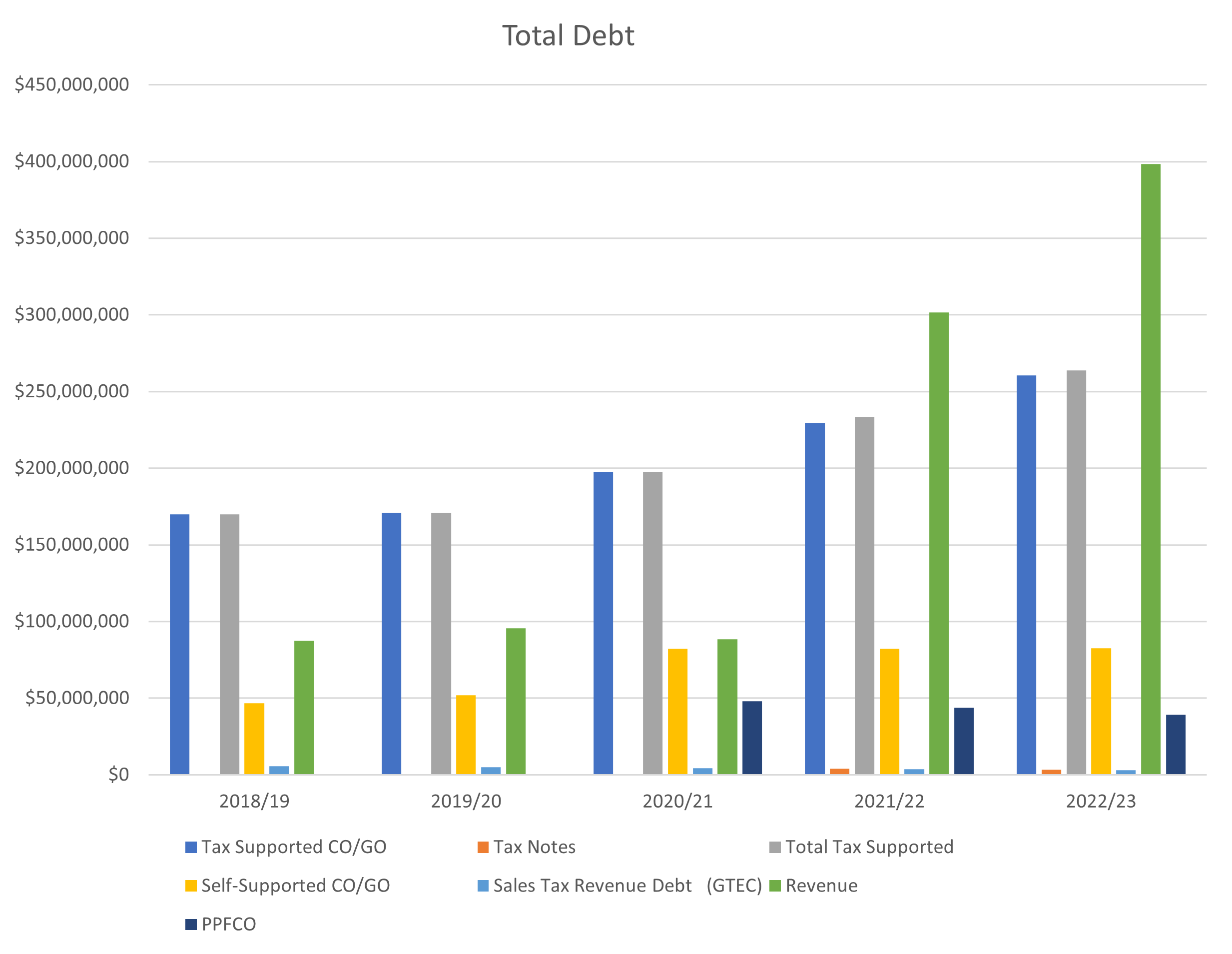

At the end of the fiscal year 2023, the City of Georgetown’s outstanding debt was $787,050,000. Of this amount $342,965,000, comprises the CO and GO debt backed by the full faith and credit of the City. From this amount, $82,598,825 is self – supported. The revenue bond totals $398,235,000. The PPFCO total is $39,310,000. The Sales Tax Revenue Bond (Georgetown Transportation Enhancement Corporation) debt total is $3,025,000. The Tax Note total is $3,515,000. Our total lease-purchase or lease-revenue obligation is $0 and the tax supported per capita is $2,826.

Click here for the link to the Comptroller’s Local Government Debt Lookup tool.

HB 1378: Debt Obligation Reporting

The 84th Legislature passed HB 1378 to increase the transparency of local government debt. Under Local Government Code § 140.008, political subdivisions, including counties, cities, school districts, junior college districts, special purpose districts, and other subdivisions of state government must annually compile their debt obligation data from the preceding fiscal year.

Current Debt Obligations as of 9/30/23: Outstanding direct debt obligations, & tax and revenue supported. Includes purpose, credit rating, outstanding principal amount, debt service, and spent and unspent proceeds issue-by-issue.

Current Outstanding Debt as of September 2023: The following book is a comprehensive list of City of Georgetown debt. It is provided by our Financial Advisors at Specialized Public Finance Inc.

Bond Authorization

2008 The City of Georgetown called a bond election for 2 propositions authorizing the issuance of General Obligation bonds for Street/Road projects in the amount of $46,000,000 and Park and Recreation projects in the amount $35,500,000 on 11/4/08. The Street/Road projects that were given authorization from the citizens were FM 971, SE Arterial 1, Northwest Inner Loop/DB Wood Rd, FM 1460, Berry Creek Dr, and a routing study for SH29. The Parks projects included purchase of parkland and open space/preserving land, pedestrian and bike trail improvements, Garey Park, & San Gabriel Park.

2015 The City of Georgetown called a bond election for 1 proposition authorizing the issuance of General Obligation bonds for Street/Road projects in the amount of $105,000,000 on 5/9/15. The projects include Northwest Blvd bridge, Rivery Blvd Extension, IH35 NB Frontage Rd, Southwest Bypass, Wolf Ranch Pkwy, Intersection/Capital Pool, Leander Bridge at IH35, NE Inner Loop, Stadium Dr (CR 151), Southwestern Blvd, SH29, Leander Rd, & DB Wood.

2021 The City of Georgetown called a bond election for 1 proposition authorizing the issuance of General Obligation bonds for Street/Road projects in the amount of $90,000,000 on 5/1/2021. the projects include SE Inner Loop, shell Rd, Williams Dr, DB Wood Rd, Leander Rd, Austin Ave, Rockride Ln, and Westinghouse Rd.

2023 The City of Georgetown called a bond election a total of 4 propositions listed below:

Proposition A would fund $56 million for the construction of a 80,000-square foot Customer Service Center that would consolidate in one central location numerous City services that are currently located in multiple offices throughout Georgetown.

Proposition B would fund $49 million for the complete renovation of the current 65,000-square-foot Georgetown Recreation Center on Austin Avenue as well as a 30,000 square foot expansion.

Proposition C would fund $15 million for an expansion to the City of Georgetown’s animal sheltering capacity. If approved by voters, City Council would pursue one of two options for expanding capacity:

-

-

-

- Entering into a partnership with four other local municipalities to expand the Williamson County Regional Animal Shelter (WCRAS), OR

- Expanding and improving the City of Georgetown Shelter

-

-

Proposition D would allocate $10 million in City funding toward the construction of a new jointly-owned YMCA center on the west side of town. These funds would enable the YMCA to build a 55,000-square-foot facility to accommodate more youth sports and childcare options.

Bond Authorization Balance Information as of November 2023: Authorized debt, issued and unissued amounts.

Additional Debt Information

Current Fiscal Year Tax Rate click here.

Debt Information from previous fiscal years can be found in adopted budgets, located on our Financial Reports page, under “Archived Annual Budget Reports”, please click here to be redirected to that page.

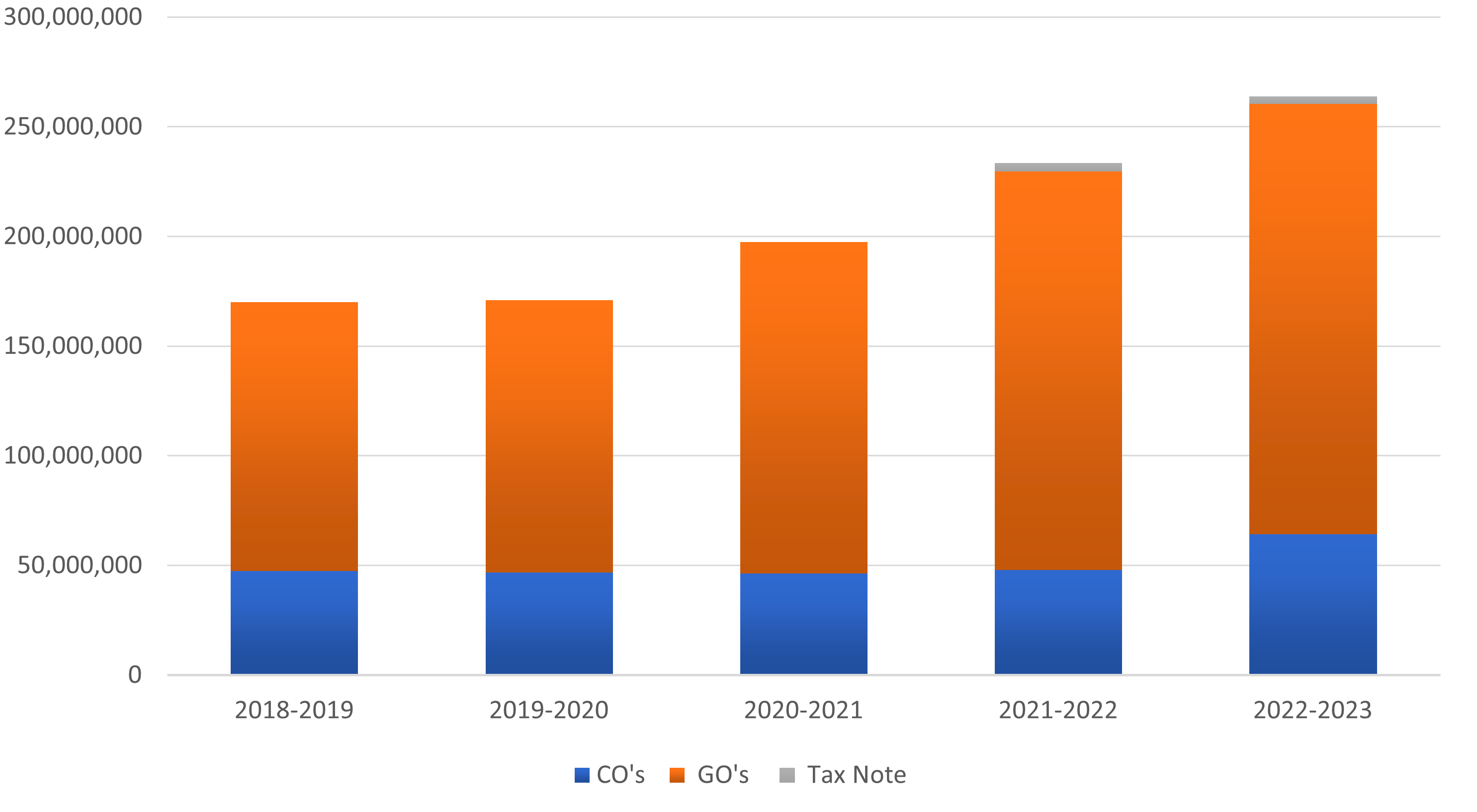

5 Year Tax Supported Debt, Not Including Self Supported Obligation

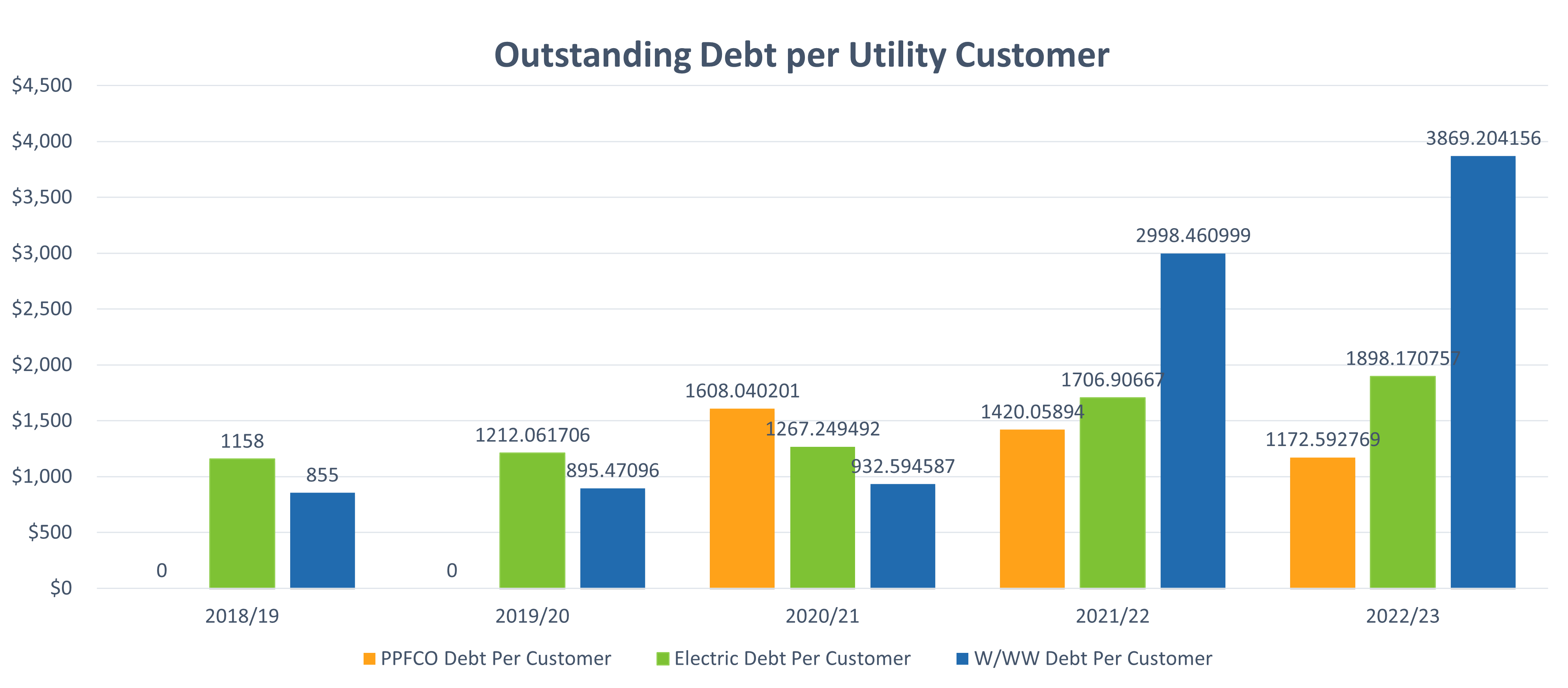

Debt Per Customer

Click here for the link to the Texas Comptroller of Public Accountants Debt at a Glance (DAAG) tool.

Click here for the link to the Bond Review Board local government debt data.

Downloadable Data

Click here for the City of Georgetown’s 5 year debt time trend.

Click here for Tax supported Debt per Capita details